October tested the resilience of both the Indian stock market and FiSC Capital’s portfolio, marking the first month of negative returns since we began. But there’s plenty of optimism and opportunity here!

Long-Term Vision, Short-Term Dip

Our seasoned investors (7-8+ months) saw this dip as a chance to strengthen their portfolios, with some expressing regret over missed opportunities to add more of our top picks earlier. Although newer investors (2-3 months) could have felt unsettled, our emphasis on patience and a long-term view helped them navigate this period confidently. In fact, many chose to invest further during the market pullback, showcasing their belief in our approach.

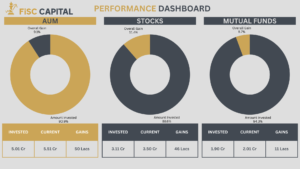

📊 AUM Growth & Portfolio Adjustments

Despite the market turbulence, our AUM grew to ₹5.5 Cr+ by November 3, 2024. Although profits dropped 3-5%, strategic reallocations to more resilient industries helped us cushion the impact. This dip doesn’t worry us; we’re invested in strong fundamentals, and the majority of our portfolio companies reported solid results this quarter.

Clearer Performance Tracking

We’ve improved our return metrics by moving from unrealized to total gains, now including dividends and realized profits. Though recent performance adjustments impacted our CAGR, we remain well above the index, and this shift provides a clearer view of long-term potential.

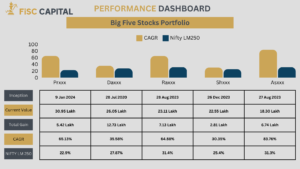

Portfolio Insights

Our Big 5 Stock Portfolios show interesting variations:

One of these is my family portfolio, which now spans from July 2020. Despite liquidating it in 2023 for personal expenses, it’s still delivered a 35.58% CAGR, with a total gain of ₹12.73 lakh—a testament to our disciplined investment approach.

Other portfolios, especially those with shorter investment periods (3-4 months), currently reflect small negative returns (5-10%). This is due to the recent market dip and a gradual alignment with our strategy.

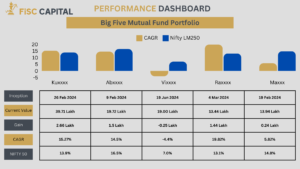

Mutual Funds & Conservative Strategy

Our mutual fund portfolio faced a more significant hit, as these funds are structured for stability with less frequent rebalancing. We’re maintaining confidence here, trusting the research behind our low-risk selections. To better reflect this conservative strategy, we’ve now benchmarked our mutual fund portfolios to the Nifty 50.

Looking Ahead with Confidence

Market fluctuations are part of the journey, and every downturn brings new opportunities. Thank you to our investors for the trust and optimism; together, we’re navigating toward long-term growth.

As always, questions and insights from our community are welcome!

hashtag#FiSCCapital hashtag#ResilientInvesting hashtag#LongTermGrowth hashtag#OctoberUpdate hashtag#StockMarket